Canadian Transit Number:

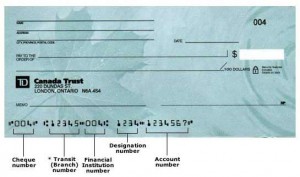

Canadian Transit Number is a 9 character code used for routing of cheques (checks) and paper instruments in the banking industry. This code identifies the branch (and bank/credit union) on which the cheque is drawn. It is also known as check routing number and MICR Code.

The format of check transit number – XXXXX–YYY

The first 5 digit is called branch transit number and identifies the exact branch of the bank. YYY is the institution code which identifies the bank or credit union. There is a dash (or hyphen) separating the branch code and institution code. As a general rule, bank institution numbers start with 0, 2, 3, or 6, while Credit Union and Caisse Populaire institution numbers start with 8, and Trust Company institution numbers with 5. The big 4 banks have the following institution code –

001 – Bank of Montreal

002 – Bank of Nova Scotia

003 – Royal Bank of Canada

004 – TD Canada Trust

Canadian Routing Number:

Canadian Routing Number is a 9 digit code used for electronic fund transfers (EFT) such as direct deposits, electronic payments, etc. The Routing Number are also formed using the branch code and bank code discussed above.

Routing Number Format

Routing number (EFT Code) is a 9 digit code comprising of a leading zero (0), the institution number (YYY), then the branch number (XXXXX). For example if a cheque MICR code is XXXXX-YYY, the corresponding EFT code would be 0YYYXXXXX.

If you want to setup a direct deposit or want to make a electronic fund transfer to someone’s account, the sender’s bank will ask for following three things –

1. Recipient’s Full Name

2. Recipient’s Account Number

3. Routing Number (and possibly the bank name)

Find Routing Number: Search for the routing number using our routing number search tool below –

For International Transfers, bank will also ask for the swift code (also called BIC code) along with the above three details.

Difference between Routing Number and Transit Number:

Both routing number and transit numbers are formed using the branch code and institution code. However, there is a difference in the format as discussed above. The term routing number is used in connection with the electronic fund transfers (EFT) and thus also known as EFT Code while the transit number is used usually in connection with the paper instruments such as cheques. You can also find transit number on the cheque issued to you by your bank. The transit number is also called MICR code.

Note: If a cheque code is XXXXX-YYY, the corresponding EFT code would be 0YYYXXXXX.

If you have any questions on the electronic payment or routing number, please leave a comment below. We’d be happy to help!